Business Insurance in and around Louisville

Calling all small business owners of Louisville!

No funny business here

Your Search For Fantastic Small Business Insurance Ends Now.

When experiencing the wins and losses of small business ownership, let State Farm do what they do well and help provide excellent insurance for your business. Your policy can include options such as worker's compensation for your employees, business continuity plans, and errors and omissions liability.

Calling all small business owners of Louisville!

No funny business here

Get Down To Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's an ice cream shop, a gift shop, or a floral shop, having the right coverage for you is important. As a business owner, as well, State Farm agent Glenn Gilbert understands and is happy to offer personalized insurance options to fit the needs of you and your business.

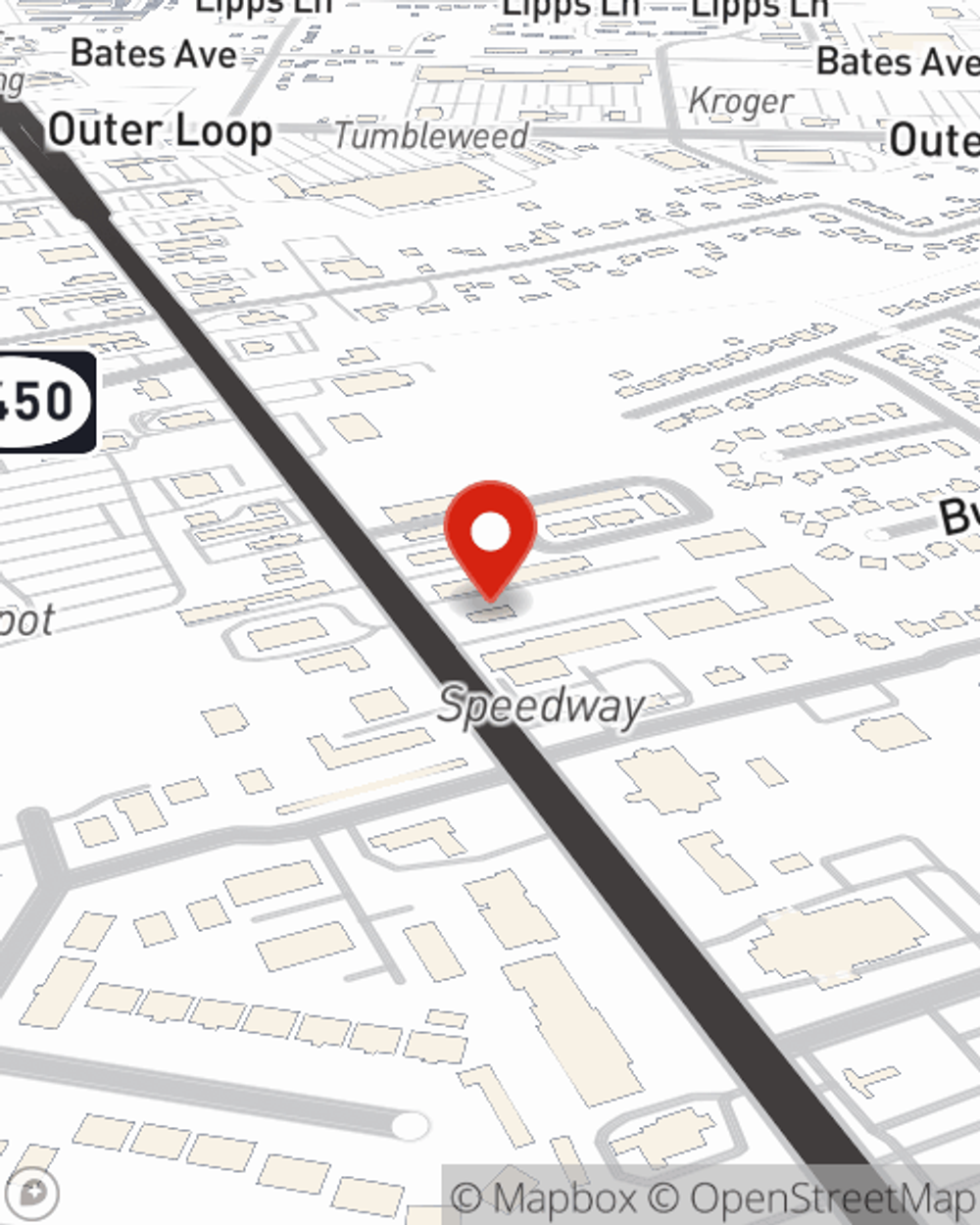

Agent Glenn Gilbert is here to review your business insurance options with you. Contact Glenn Gilbert today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Glenn Gilbert

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.